The cutting edge field in Finnish innovation and industrial policy has for the past few years been cleantech. The focal point of Finnish cleantech is traditionally in industrial solutions that spring from innovations in process industry companies. Now the situation is changing, as cleantech startups spring up in consumer markets. Meanwhile the growth logic of cleantech companies changes, as more and more companies start exploiting the opportunities presented by digitalisation.

According to the Finnish Ministry of Employment and the Economy, the production of clean technology, or cleantech

comprises the processes, closed systems, products and services that promote sustainable use an efficient productivity of natural resources. Cleantech maximises material, water, and energy productivity both economically and technologically. At the same time Cleantech reduces emissions into waters, air and land.

In this way, any service, product or process of any company, that offers both competitive profits for investors and solutions to global environmental problems (like energy poverty or climate change) can be cleantech.

As cleantech has gained ground, the Finnish economic environment has seen a remarkable enthusiasm towards startup companies. The term startup refers to companies that grow with considerable speed, like Airbnb, Uber and Dropbox. Rovio Entertainment and Jolla are examples of Finnish startups. Perhaps the most dynamic definition of a startup comes from the entrepreneur and academician Steve Blank. According to his definition, a startup is

1) designed to search for a repeatable and scalable business model. A startup does not fit the mould of a traditional company: its only mission is to experiment, get a feel of the market and see what works.

2) a temporary organisation. As soon as the business idea proves workable and the company starts expanding its business, it is by definition no longer a startup.

A ’startup’ can be understood as a phase in the evolution of a company. It is a phase where the company has yet to make profit, but actively searches for a profitable business model. If the experimentation bears no fruit, the company will wither away. But if the experimentation proves successful, the company will move from the startup phase on to a lucrative company.

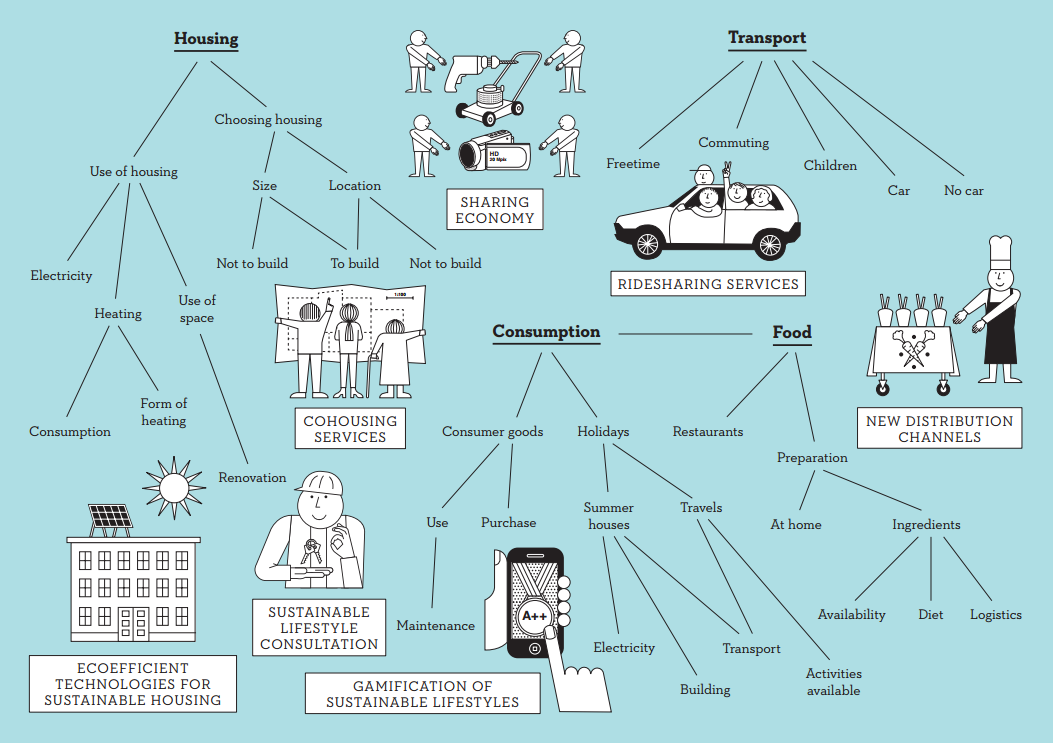

During the last year the world has experienced a new wave of cleantech, directed at consumers. The largest startups in the world, Airbnb and Uber, are examples of startups (or rather, smartups) working in the highly resource-intensive fields of housing and transportation. Consumer cleantech companies have sprung up above all in the following four categories:

Collaborative consumption, making better use of current resources. Examples include startups like Airbnb, Uber, Swap.com, Piggybaggy and Yerdle.

New distribution systems for ecological food, transportation and housing. These startups provide quicker market deployment for more ecological technologies, and include concepts like Tesla, and web-shops for solar cells.

Radically more ecological consumer products in the fields of food, housing and transportation, such as Beyond Meat, EV-cars and plant based food.

Behavioural change through information feedback, like gamification, pricing and metering, companies including Citygame and the consumer applications of the ESCO model.

Services in the urban context, like smart city applications, urban agriculture, online-offline-hybrid shops. Startups like Nest and Quick Sense that support smart energy consumption are examples of this.

Why is consumer cleantech as a business particularly interesting?

From the consumer’s point of view, innovations of consumer cleantech are associated to the biggest resource-consuming activities, housing, transportation and food. This makes these particular fields economically very appealing. As an example, in the EU people spend on average 33.2% of their income on housing, 11.9% on transportation, and 16.8% on food (converted into ARPU figures popular among startups, these activities demand 3 700€, 1 800€ and 1700€ respectively). In comparison, Europeans use only 3.3% of their income on communications and 8.3% on recreation and culture. Thus, consumer cleantech carries great potential.

While processes become more efficient and cleantech expands its reach, the explosive spread of the middle class and its lifestyle, especially in developing countries, is based on the increased productivity of resources. From the global perspective, expanding into consumer markets makes sense, not only from an economic point of view, but also necessary regarding efforts to contain climate change and resource consumption.

Consumer cleantech usually has to do with creating new markets and changing the behaviour patterns of consumers. These types of changes often call for collaboration and require an ecosystem of a range of actors. Good examples of this are the solutions of housing and transportation, where the creation of new markets necessitate cooperation between cities, states, and traditional property, construction and energy business and startups.

This brief introduction gives background to the Demos Helsinki Sustainable Growth analysis, in particular the second cutting edge proposition.

Further reading:

Steve Blank talks about the philosophy of startups in the article A Startup Conversation with Steve Blank

Mariana Mazzucato’s and Carlota Perez’s working paper Innovation as Growth Policy: the challenge for Europe concerns the role of the government in supporting innovation